U.S. ski areas saw a record 61 million skier visits for the 2021-22 season, an increase of 3.5 percent year over year, according to data from the National Ski Areas Association (NSAA).

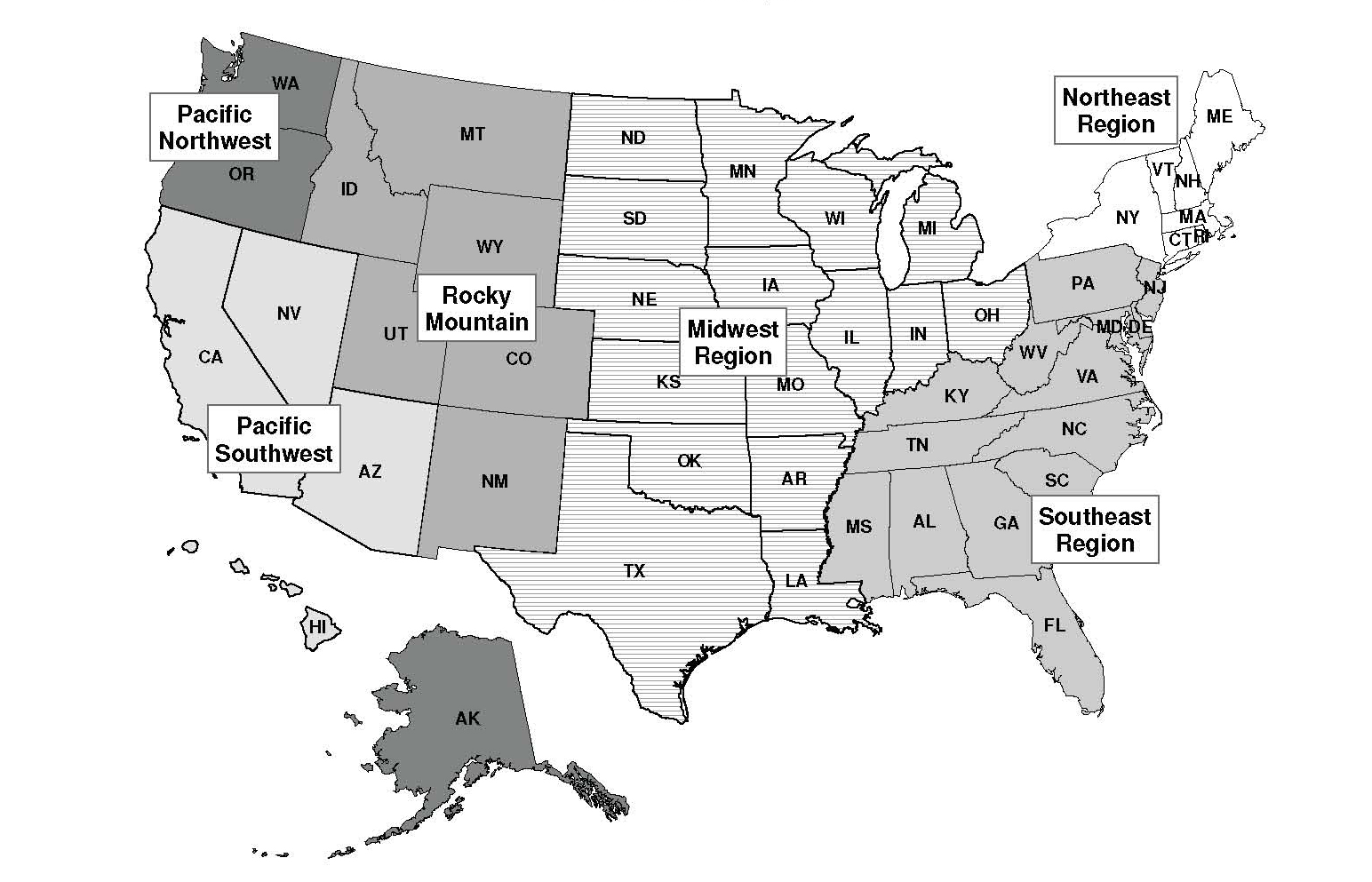

The Rocky Mountain region reported a record high number of skier visits, totaling 25.2 million visits. The Northeast, Midwest, and Pacific Southwest also reported increases compared to 2020-21, while the Southeast and Pacific Northwest reported the only decreases season-over-season.

There are several other growth indicators. The number of operating ski areas grew from 462 to 473 last season to this season. Ski area capital investment is also projected to reach a new high at $728 million for the upcoming capital season. Over the past three seasons, the average ski area has invested $16 per skier visit back into its operation, reports NSAA.

Historically, high skier visits have correlated to high snowfall. This year, however, the average snowfall was 145” nationally, lower than the 10-year average of 166”. Ski areas also navigated staffing challenges this season, with approximately 81 percent of ski areas reporting they were not fully staffed, with an average of 75 positions left unfilled.

NSAA attributes the growth to strong season pass sales and a continued desire for outdoor recreation. For the third season in a row, season passes surpassed day tickets in share of skier visits, with season pass holders comprising 51.9 percent of visits and day tickets accounting for 37.3 percent of visits (the remainder is made up of off-duty employees, complimentary products, etc.). Additionally, in all regions, ski areas of all sizes, from small to large, saw an increase in number of season passes sold.

NSAA has been tracking skier visits since the 1978-79 season; its historical visitation numbers can be found here and their overview overview is below:

Regional impacts

NSAA divides the country into six regions. The Rocky Mountain region reported a record high number of skier visits, totaling 25.2 million visits. Other regions with increases in season-over-season skier visits were the Northeast, Midwest and Pacific Southwest. Only two regions – the Southeast and Pacific Northwest – reported decreases in skier visits compared to 2020-21.

What the number means

This record visitation signals that the U.S. ski industry is healthy, and that the demand for outdoor recreation remains strong. There were signs of this during the 2020-21 season as the realities of the Covid-19 pandemic led more people to seek outdoor activities. Strong skier numbers bode well for the long-term health of the sport, especially since participant numbers have been relatively flat over the past decade. The number of operating ski areas also jumped from 462 last season to 473 this season, another positive indicator.

Snowfall

Historically, changes in skier visit numbers could be correlated with snowfall; more snow generally meant more skiers. However, the average snowfall this season was 145” nationally, lower than the 10- year average of 166,” signaling once again the strong desire for people to get outside.

Capital investment

Capital investment by ski areas is projected to reach an all-time high, totaling $728 million for the upcoming capital season. Over the past three seasons, the average ski area has invested $16 per skier visit back into its operation, as evidenced by the installation of new lift infrastructure, terrain expansion, workforce housing, upgraded dining and other amenities.

Season passes holding strong

For the third season in a row, season passes surpassed day tickets in share of skier visits. Season pass holders made up 51.9% of visits nationally, with day tickets claiming 37.3% of visits (the balance is claimed by off-duty employees, complimentary products, etc.). Ski areas of all sizes, from small to large, in all regions of the country saw an increase in number of season passes sold.

Staffing

Like many industries, the ski industry struggled to attract and retain staff for the season. Approximately 81% of responding ski areas reported that they were not fully staffed, with an average of 75 positions left unfilled. Ski areas responded by raising wages, adding end-of-season bonuses, and investing in affordable workforce housing.

Ski the World