Since becoming the CEO of Vail Resorts in 2006, Rob Katz has led the company in the acquisition of nine properties, discounted the cost of season passes, and persuaded his customers to market the brand making him skiings most powerful man. What does he have planned next?

The chairman of the board and CEO of Vail Resorts doesn’t work in a stereotypical corner office. Rob Katz’s home base is an expansive glass-walled area on the 10th floor of the corporation’s LEED-certified building in Broomfield. Massive west-facing windows frame the Front Range foothills and offer an enviable view of the red-rock Flatirons and deep canyons. Inside the office, there’s a comfortable denlike area with overstuffed chairs and photos of Katz’s family hanging on the wall. On the opposite side of the room, there’s a conference table that seats eight and a large, formal chestnut-colored credenza. The entire space broadcasts success and sophistication and vision—which is why the foam Legos sitting atop the desk’s glossy surface are so incongruous.

Four stacked rectangles, four colors. Red on top. There are also yellow, green, and blue blocks. Are they toys, a nostalgic nod to his teenage sons’ youth? Or perhaps the modern equivalent of Baoding meditation balls?

They’re neither: The blocks are part of a corporate-leadership training curriculum whose design and implementation Katz considers one of his greatest accomplishments as CEO. The colored blocks, in this instance, signal to all Vail Resorts employees who Katz is in the workplace, represent his strengths, and communicate his work style (Katz’s dominant color is red, indicating a driven approach). Nearly all of the company’s managers have completed parts of the multi-tiered training program and emerged with their strengths, communication styles, likes, and dislikes distilled into four colored blocks. The goal? To develop empathy and the ability to work with people who have different dominant colors—to “flex,” in corporate speak. “At first I completely thought it [the colored-block method] was juvenile and simplistic,” Katz says. “But it was one of the greatest things we’ve ever done, because it gave a language to who you are. All of a sudden you went around the company and people disclosed an incredible amount about themselves in a very easy, one-word answer.”

The curriculum is founded on five tenets of leadership: self-awareness (you can’t lead others unless you know yourself); vulnerability (being brave, not perfect); candor (being truthful with others with positive intent); emotional agility (adapting to changing circumstances); and sitting with tension (the ability to hold opposing concepts simultaneously, such as preserving the core and driving change). Instilling these values throughout the corporation is one reason Vail Resorts has been so successful, says Luis Benitez, director of the Colorado Outdoor Recreation Industry Office and a former Vail Resorts employee. (Benitez designed leadership-development programs for the company after Katz became CEO.) “Rob has created a corporate culture that honestly encourages people to connect who they are with what they get to do every day,” Benitez says.

This is what’s known as emotional intelligence in psychology and leadership circles, and to the uninitiated, it can sound a bit New Agey. Katz himself concedes it’s the type of thing that can be easily dismissed, which is why he’s worked tirelessly over the years to get corporate-wide buy-in of the program. But Coloradans don’t generally shun the cosmic-karmic. Here, Buddhist monks might rub shoulders with yoga-practicing triathletes who also happen to run their own technology companies. In many Colorado corporate cultures, the “greed-is-good” Wall Street ethos is the exception, not the rule. So maybe it’s not a surprise that Vail Resorts prioritizes emotional intelligence.

Except there’s this: Before becoming CEO of Vail Resorts in 2006, Rob Katz was one of those Wall Street finance guys. And just because he prioritizes emotional intelligence professionally and personally—in 2015 he donated $1 million to the Wharton School of the University of Pennsylvania to establish the Katz Fund for Research on Leadership and Emotional Intelligence—doesn’t mean he rejects the traditional rewards bestowed upon successful CEOs. At press time, Vail Resorts’ stock was trading at $167, and Katz’s total 2015 compensation, which includes his salary, bonuses, and stock options, was about $6.15 million. You could say embracing the power of vulnerability and creating a culture where criticism is welcome and top brass are expected to flex to meet the needs of their colleagues is working out quite well for the chairman and CEO of one of the largest ski resort companies in the world.

The first time Rob Katz visited Vail, he slept on the floor of a friend’s father’s house. It was 1991, a couple of years after Katz had earned his bachelor’s at Penn’s Wharton School. The trip was a vacation from his nascent career in finance, and the resort awed Katz, an East Coast skier accustomed to ice and cold. “We got on the mountain, and it was almost like we were doing a different sport,” he says. “I was absolutely blown away. It was Vail. You hear about it all the time—the mountain, the weather, the snow. There was lots of anticipation.”

If this were a different story, the narrative would go something like this: After that impressionable trip, Katz, a native New Yorker and Ivy League graduate, would heed the siren song of the Rocky Mountains. He’d sell all of his possessions and migrate West to join the legions of young men who make annual pilgrimages to the mountains for lifestyles that revolve around snow, 100-plus ski days each winter, and powder shots. Put another way: He’d become a ski bum.

But Katz didn’t want the mountain life back then. He was a young, ambitious businessman eager to make good money in the lucrative world of finance. After graduating from college in 1988, Katz had joined Drexel Burnham Lambert, a major Wall Street investment banking firm that went bankrupt 18 months later. Katz moved to Smith Barney Inc. before becoming an early employee at a new private equity firm called Apollo Global Management LLC, which was started by his old boss from Drexel.

That was August 1990. Then came the trip to Vail, and then came a decision by the firm that would prove pivotal to Katz’s career: In 1992, Apollo took control of Gillett Holdings Inc., a bankrupt company that owned Vail Associates. Eventually, Apollo restructured the company and expanded its operations, merging Vail and Beaver Creek with Keystone and Breckenridge to create Vail Resorts. Katz worked on these transactions and joined the board of Vail Resorts before Apollo took the company public in 1997. The initial public offering price was $22.50 per share. Katz was 30 years old.

By 2004, Apollo had divested itself of its Vail Resorts stock, but Katz, who had moved to Boulder with his family for a post-9/11 lifestyle change, was still on the company’s board. In fact, he was lead director and in charge of finding a new CEO. When some board members asked if he’d consider taking the position, Katz was intrigued but cautious.

Since moving, work had taken something of a back seat to family life and self-improvement. In 2003, Katz had enrolled in a long-term course with the Matrix Leadership Institute, whose seminars promote self-examination and vulnerability as critical to becoming an effective leader. His sons were six and four at the time, and his wife, Elana Amsterdam, had just started the grain-free, paleo recipe blog elanaspantry.com, which would lead to her success as a New York Times best-selling author of three cookbooks. How would heading up a major resort company change the comfortable life they’d built?

Still, the prospect of running Vail Resorts appealed to Katz, who saw significant potential in the destination travel business. The company already owned some of the most popular ski resorts in the world and employed scores of passionate staffers. At Apollo, where Katz honed his acumen for acquiring companies, he’d learned to look for organizations with positive employees. Katz believed that if he could foster the existing motivation of Vail’s employees, that passion could drive the business places no one imagined were possible. “At Vail Resorts, we had everybody inspired, in general,” Katz says. “The question was if they were inspired about the mountains or about the company.”

Before he took the job, Katz wanted to make sure he and the board were aligned when it came to the future of Vail Resorts. “I wanted the board to absolutely know there would be changes…and I knew that not everything would go well,” Katz says. “You try new things, and some of it works and some doesn’t. Some people will like what you’re doing, some won’t, and the board needed to be OK with that.” The board was more than OK with that, and in February 2006, Katz became CEO of Vail Resorts. The ski industry hasn’t been the same since.

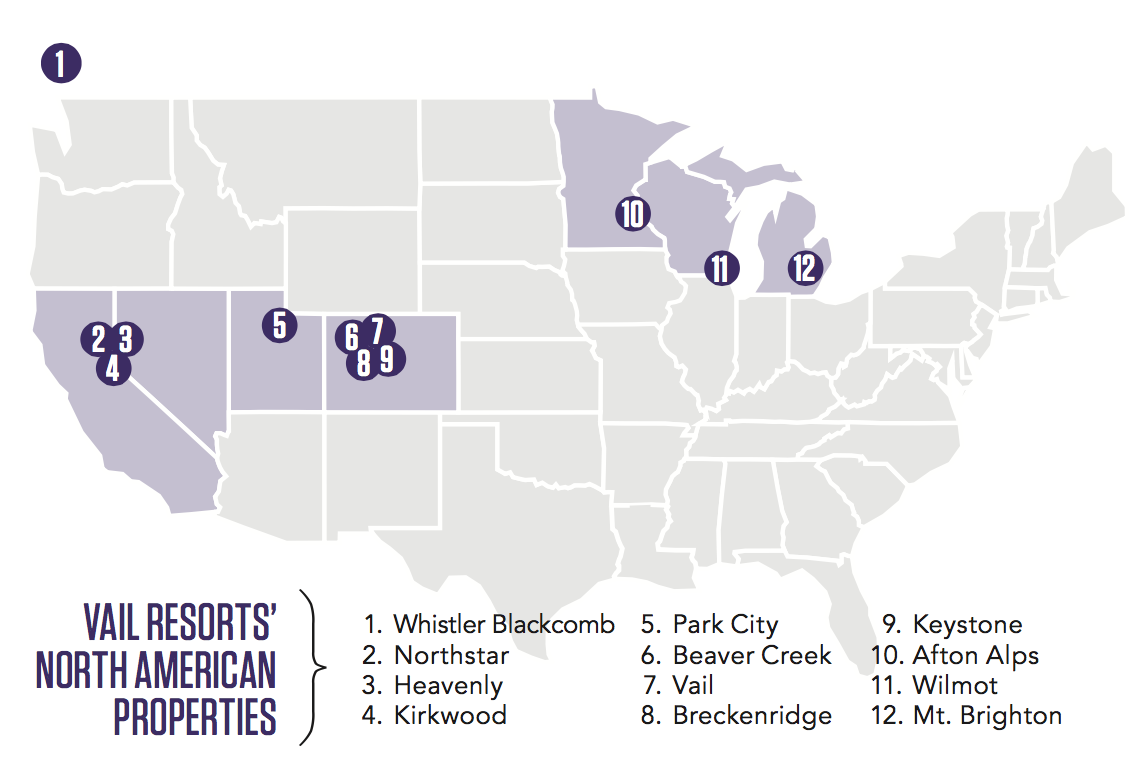

The company Katz signed on to lead was already big. When he took charge in 2006, Vail Resorts owned five ski resorts—Colorado’s Breckenridge, Keystone, Vail, and Beaver Creek, along with Lake Tahoe’s Heavenly. Stock was trading at $33. Katz was determined to make Vail Resorts a multinational corporation, and his first order of business was to move the company from its mountain headquarters in Avon, Colorado, to a 10-story building in Broomfield’s Interlocken office park. The move shocked and angered many of the mountain-based employees. Those who were fervent about the mountains declined to move. And those who migrated to the Front Range to keep their jobs—or take promotions—were warned not to gripe. “Rob saw this was big business that needed to be taken more seriously,” says a former Vail Resorts employee who moved from the mountains to Broomfield. “Some people were resentful. They loved the sport and didn’t want to think of it as big business, especially one driven by a Wall Street guy.”

For others, the move breathed vitality into a workplace that had become stagnant. Matt Jones, now senior director of human resources for Vail Mountain, was one of the Avon guys who moved to Broomfield. Five months before the corporate headquarters relocation, Jones’ boss resigned. Jones could have been set adrift—he was leaving the mountains and upending his life to work in a Denver suburb. But Katz’s vision smoothed the transition, he says. “I remember Rob pulling me into his office [the day after my boss resigned] and telling me that he saw people as the company’s greatest asset and that he was committed to building good leaders,” Jones says. “At the time, I appreciated it. It wasn’t just the opportunity for personal growth but that he had that clear vision and wasn’t afraid to lay it out there and talk about it.”

That early vision did not include collaborating with other Colorado ski resorts. In another bold move, Katz pulled Vail Resorts’ membership from the industry trade group Colorado Ski Country USA (CSCUSA) in 2008. His main complaints were that the organization spent too much on marketing and didn’t pay enough attention to government affairs. Vail Resorts, the company with the most skier days of CSCUSA’s members at the time—today there are 22 members—opted to go it alone.

Losing Vail Resorts was a blow to CSCUSA. The group scrambled to convince the company to stay, holding three meetings over about a month. Tom Jankovsky, who was chairman of the organization’s board when Katz decided to leave, recalls that Katz attended the third and final meeting after sending someone else to previous ones. Katz was not convinced by the trade group’s promise to drastically cut the marketing budget through a reduction in dues and still had issues with how the organization was approaching things such as lobbying. “It left a bad taste in my mouth,” says Jankovsky, noting that it was the first and only time he’d interacted with Katz. “I thought we were negotiating in good faith, and my take on Rob Katz at that moment was that he was micromanaging the decision.” Kelly Ladyga, vice president of corporate communications for Vail Resorts, says the company has since developed a good working relationship with CSCUSA and collaborated on various public policy issues and projects, including an economic impact study of the ski industry that was released last year.

Katz knows he’s been controversial—and not just for moving company headquarters or leaving CSCUSA. Under his watch, Vail Resorts pounced on the opportunity to initiate a new lease from the existing owner of Utah’s Canyons Resort when an administrative oversight in 2011 inadvertently left the Utah destination up for grabs. The lease was owned by Talisker Land Holdings LLC, and although Talisker owned the land that acted as the actual ski area—the slopes—another corporation, Powdr Corp., owned the base area and leased the mountain from Talisker. Once Vail Resorts had the operating lease for Canyons, they set their sights on the Park City ski resort four miles away. After an arduous legal battle, Vail purchased Park City Mountain Resort in 2014 for $182.5 million. The following year, the company spent $50 million at the Utah properties, in part to connect Park City and Canyons to create the largest ski resort in the United States, with 7,300 skiable acres. Vail Resorts’ reputation for getting anything it wants, thanks to its deep pockets and sheer size, has resulted in the labels “Evil Empire” and “600-pound gorilla.” By his own account, Katz has been described as calculated. (Interestingly, Katz is one of the very few who give voice to this depiction: Of the more than a dozen past and current employees approached for comment for this article, most declined to be interviewed, as did former U.S. Senator Mark Udall, who worked closely with Katz to pass 2011 legislation that has allowed mountain resorts to increase summer operations.)

And the company’s pace is relentless. “Rob moves incredibly fast and the company moves fast,” Benitez says. “But that’s part of what garners the most talent. People who gravitate to the company are folks who like that challenge.” In September 2016, one disgruntled former employee described the experience at Vail Resorts as “absurd,” writing on glassdoor.com that the company has “a super toxic corporate culture that goes unnoticed and is taboo to even talk about.”

For his part, Katz says that the Vail Resorts culture is “highly engaged.” Despite the company’s size—about 5,000 year-round employees and 25,000 seasonal workers—“you won’t be able to hide,” Katz says. “If you want to put the blinders on and go to your desk and do your work and do nothing else, this is probably not the best place.”

In person, Katz is confident but unpretentious. He intersperses his conversations with thoughtful pauses and leaves the impression that little fazes him. He wasn’t a whole lot different a decade ago when he was a new CEO just months after his 39th birthday. He was—and remains—focused on bringing, as he puts it, sophistication to the business of skiing. “When I took the job, I had one overarching question,” Katz says. “Could we reimagine everything about the ski business while at the same time protecting its core?”

Here are a few things he has decided Vail Resorts is not: a beach resort, a cruise line, a casino company. Vail Resorts is not going to take you sailing in the Caribbean or zip-lining through the Costa Rican jungle. What it will do, says Katz, is deliver a high-end mountain vacation experience. Will that involve skiing or snowboarding? Probably. But it doesn’t have to. “To create a great company, identify what the core is and innovate around that,” Katz says, paraphrasing Boulder-based business guru Jim Collins, author of Good to Great: Why Some Companies Make the Leap…and Others Don’t. “Our core is mountain resorts. This includes skiing and dining and retail and spas and golf and festivals—all the different things that energize a mountain resort.”

Today, in addition to its mountain destinations, Vail Resorts owns a transit company, a number of lodges and restaurants, retail shops, snowsports schools, gear-rental operations, condominiums, golf courses, and real estate in and around resort communities. Some critics have called this the Disneyfication of the sport and charge that Vail Resorts’ approach bleeds mountain towns of their authentic characters as they cater only to wealthy visitors who have indiscriminate tastes. Vail has been decried as soulless and sanitized and called a “shake-and-bake Bavaria.” But spend some time at the different Vail Resorts destinations, Katz argues, and this generalization doesn’t bear out.

Vail was founded in 1962 by Pete Seibert, a World War II veteran, and Earl Eaton, a Vail Valley local from nearby Eagle. The town imitates the villages of Europe’s Alps not because its founders wanted it to look like a theme park but because as a child Seibert fell in love with images in a magazine of an Austrian ski resort. Breckenridge, with its mining history, Victorian architecture, and robust town, is vastly different from Tahoe’s Northstar, a family-friendly resort with lodging and retail concentrated in the base village. And Park City, another former boom-and-bust mining town that hosted some 2002 Winter Olympics events, is a quaint mountain community about 30 miles southeast of Salt Lake City. “The most successful resorts we have are the ones with the most diverse and vibrant towns,” Katz says. “And to have a diverse and vibrant town, you need many different retailers and hotel operators and restaurateurs.”

Still, there’s an undeniable, intentional patina to the restaurants, hotels, and shops owned by Vail Resorts, and those stand out in all the company’s properties. That’s actually a Katz trademark—investing in amenities and properties, constantly upgrading, and marketing the resorts as a whole—says Marc Peruzzi, editorial director of Mountain Sports Media and former editor-in-chief of Skiing Magazine. Peruzzi recalls recommending Taos Ski Valley to a friend several years ago, praising the northern New Mexico resort’s no-frills attitude and expert terrain as well as the region’s indigenous Pueblo culture. His friend didn’t like it. “Ever since, he’s taken his once-a-year ski vacation at a Vail resort,” Peruzzi says. “Some people want that core skiing vibe, and other people want things to be laid out for them. Neither is right. So long as people are going to the mountains, that’s good for the industry.”

The flagship, Vail Resort. Courtesy of Vail Resorts

Having identified the essence of his business, Katz moved on to innovation. He landed on an early success with the 2008 release of the Epic Pass, a discounted season pass that gives holders access to all of Vail’s resorts (currently there are 13) and select days at a suite of other spots (for 2016-’17, this includes properties in Austria, France, Italy, and Switzerland and Canada’s Whistler Blackcomb). “One of the challenges of the ski industry historically was always weather,” Katz says. “If it snows, you make a lot of money, and if it doesn’t, you don’t, and that’s just life. The question was whether there was a way to address that. What came out of that was the season pass.” In 2008, when it was launched, the Epic Pass cost $579; a 2016-’17 pass cost $849. Last season, sales from season passes generated approximately $263 million.

Today, Vail Resorts sells more than 500,000 passes in all 50 states and 80 countries around the world. Sales of all-seasons passes were up 13 percent last season (when compared with 2014-’15), and preseason pass sales account for 40 percent of the company’s lift-ticket revenue. “The Epic Pass rewrote the rules for season-pass sales,” says Michael Berry, president of the National Ski Areas Association, of which Vail Resorts is a member. “Rob was the driving force in the company’s commitment to make the Epic Pass the game changer it has become.” By discounting season passes so significantly, the Epic Pass gave Vail Resorts more predictable ticket-sale income while safeguarding against unpredictable factors like the weather. The pass drives traffic to the resorts and cultivates loyalty.

Of course, not everyone is a fan. The Epic Pass has led to crowded slopes, which can create unsafe conditions, especially at Vail, says Packy Walker, a Vail resident who moved to the valley in 1966. “It’s hard enough to teach people how to ski and proper behavior and etiquette on the slopes, and then you throw affordable passes on top of it,” Walker says. “It’s become difficult to ski on the mountain.” (Vail Resorts disputes this characterization of its flagship property.)

But Katz’s strategy is a winner for Vail Resorts shareholders. Having followed and owned Vail stock over the past decade, Jordon Laycob of Marsico Capital Management LLC praises Katz’s leadership for creating strong devotion to the brand with the Epic Pass. Unrestricted full-season passes at top-tier resorts like Jackson Hole in Wyoming, Aspen, and Utah’s Alta start around $1,000 per season and run to more than $2,000. “Meanwhile, the Epic Pass lets consumers enjoy five Colorado mountains, plus [resorts in] Utah, Tahoe, and Whistler,” Laycob says. “This access takes the Epic Pass from a locals’ product to an international one that locks a lot of people into the Vail ecosystem.”

That, along with making skiing and snowboarding accessible to more people, was the point. “There were people who said that [with the Epic Pass], we were allowing Front Range riffraff to come ski Vail,” Katz says. “My reaction was, ‘Wait a minute. If we’re making skiing more affordable for families and helping to promote long-term engagement in the sport, isn’t that a good thing?’ ” More than 10 million people visited Vail Resorts mountains last season, and in 2016, company revenue was $1.6 billion and net income was $149.8 million.

Two years after the Epic Pass release, Vail Resorts introduced another game changer: EpicMix. Using RFID (radio-frequency identification) chips embedded in lift passes, the social media app originally tracked skiers’ and riders’ vertical feet and allowed users to earn digital pins for accomplishments on the mountain. More additions followed: Now you can do things like share photos, track your kids at ski school, estimate lift times, and check the snow report. The app arrived just as the gamification of certain experiences via social media was exploding. Give your customers unlimited ways to broadcast their days’ exploits, and you just tapped into the “best advertising you can get,” Katz says. Although the company doesn’t release the number of EpicMix shares, Katz says it’s in the millions. And that, he says, is “worth real money.”

Whistler Blackcomb, owned by Vail Resorts —Courtesy of Vail Resorts / Justa Jeskova

Whistler Blackcomb, owned by Vail Resorts —Courtesy of Vail Resorts / Justa Jeskova

When Katz became Vail’s CEO, he started spending—lifts needed to be replaced, restaurants required remodeling. In the past decade, Vail Resorts has spent $1.1 billion on capital improvements. Initially, shareholders and investors criticized the expenditures, saying the company should save its capital to keep it on hand to build the brand. But to Katz, having some of the best amenities was building the brand.

The most significant costs have come from Vail Resorts’ continued acquisitions of new mountains, the most recent of which was British Columbia’s Whistler Blackcomb ($1.06 billion) this past October. Vail Resorts now owns the top three most-visited ski resorts on the continent—Whistler Blackcomb, Vail, and Breckenridge—and starting in November 2017, Whistler Blackcomb will be included on the Epic Pass. (This season’s pass allows five days at the storied behemoth some 75 miles north of Vancouver.) The move will provide more capital for improvements at Whistler and will help Vail Resorts lure Canadians and Asian visitors—Whistler has the highest Asian visitation of any North American resort—to its other properties, says Dave Brownlie, CEO of Whistler Blackcomb. Once a competitor with Vail, Whistler Blackcomb now falls under its aegis, and Brownlie says that’s a boon for both parties. “Having been on the other side, competing with Vail, I can tell you everyone watches what they do,” Brownlie says. “Vail is definitely pushing forward, and that keeps everyone on their games.”

Since becoming CEO, Katz has led the acquisition of Whistler, Tahoe’s Northstar and Kirkwood, Utah’s Park City Mountain Resort (Park City and Canyons, combined), Afton Alps in Minnesota, Mt. Brighton in Michigan, Wilmot Mountain in Wisconsin, and Australia’s Perisher. Providing Epic Pass holders access to such a broad and, in some cases, esteemed group of resorts has built “the ultimate loyalty program,” Katz says. There is a strategic connection among the resorts Vail acquires—namely, the ability to add value to the Epic Pass. “There are some companies and people who have owned ski resorts, and for them, it’s like having a collection of jewels,” he says. “They have four or five jewels, and the question is if that’s going to be a successful company. We took the approach of wanting to create a company where all the resorts truly fit together.” Whistler, for example, has robust summer visitation and a strong connection to the Asian market, where analysts expect future growth, particularly from China and Southeast Asia. Park City appeals to the Los Angeles market. The Midwest’s Wilmot, Afton Alps, and Mt. Brighton serve as feeder areas to the company’s larger resorts. Australia’s Perisher, which Vail purchased in 2015, presents the company with an opportunity to boost North American skier visits because Perisher is now part of the Epic Pass.

This pleases investors. “You’ve seen Vail Resorts keep the owned mountains in fantastic shape, constantly upgrading them while adding on to the portfolio of ski resorts in other states,” Marsico Capital’s Laycob says. “It’s like the pieces of a jigsaw puzzle coming together.”

Katz plans to build on the strategy he set a decade ago, but he recognizes this entails more than buying a bunch of resorts and convincing people to vacation—and spend their money—at them. Mountain communities face real struggles, including a lack of affordable housing for seasonal employees and the prospect of a warming planet, which scientists and most industry leaders agree threatens long-term snowpack and the sports of skiing and snowboarding.

In December 2015, Vail Resorts said that it was making a $30 million investment to partner with private developers and municipalities to build affordable employee housing in all Vail Resorts communities. On climate change, Vail Resorts has a company-wide energy reduction program and continues to seek ways to lower its carbon footprint, Katz says. The company has also signed on to several measures, including a letter crafted to support President Barack Obama in advance of the 2016 Paris climate talks and a letter from the National Ski Areas Association to support the Clean Power Plan. Notably, Vail Resorts has not joined Protect Our Winters (POW), a Boulder-based climate advocacy group for the outdoor recreation industry whose members include Patagonia, the North Face, Burton Snowboards, and Clif Bar, among others. (In Colorado, Aspen Snowmass and Arapahoe Basin are resort partners.) Katz says he’s opted not to join POW because membership in the group could alienate a broader audience. “Global warming and climate change is not about skiing,” Katz says. “It is about the health of the entire planet. Of course skiing is there, but making it so narrow loses a lot of people in the effort around climate change. I don’t think skiing at Vail and Aspen is what everyone is worried about. That’s actually the least of anyone’s worries.”

In the meantime, Katz is eyeing more resorts to buy, though he won’t say which ones. He’s launched the EpicPromise Foundation to provide funds for employees in need of emergency financial relief and to help them pursue educational opportunities. This past summer he debuted Epic Discovery—in collaboration with the Nature Conservancy and the U.S. Forest Service, the program broadened the resort’s summer activities, with an emphasis on environmental stewardship—at Vail and Heavenly. And if the past is a prologue, he’s likely working on another release of something innovative. That seems to be the consensus among analysts and industry insiders. Consider what Mammoth Resorts chairman Rusty Gregory told Ski Area Management magazine in its July 2016 issue: “Some people think of Vail as the Evil Empire, but if you look at what Rob has done to revolutionize the industry (because a lot of us are following in bits and pieces what he is doing), I think it will be very interesting to see what he does next. What he does might be the most important thing that happens in the industry in years to come.”

By Rachel Walker, a freelance writer in Boulder. Email her at letters@5280.com.

Source: 5280 Denvers Mile High Magazine